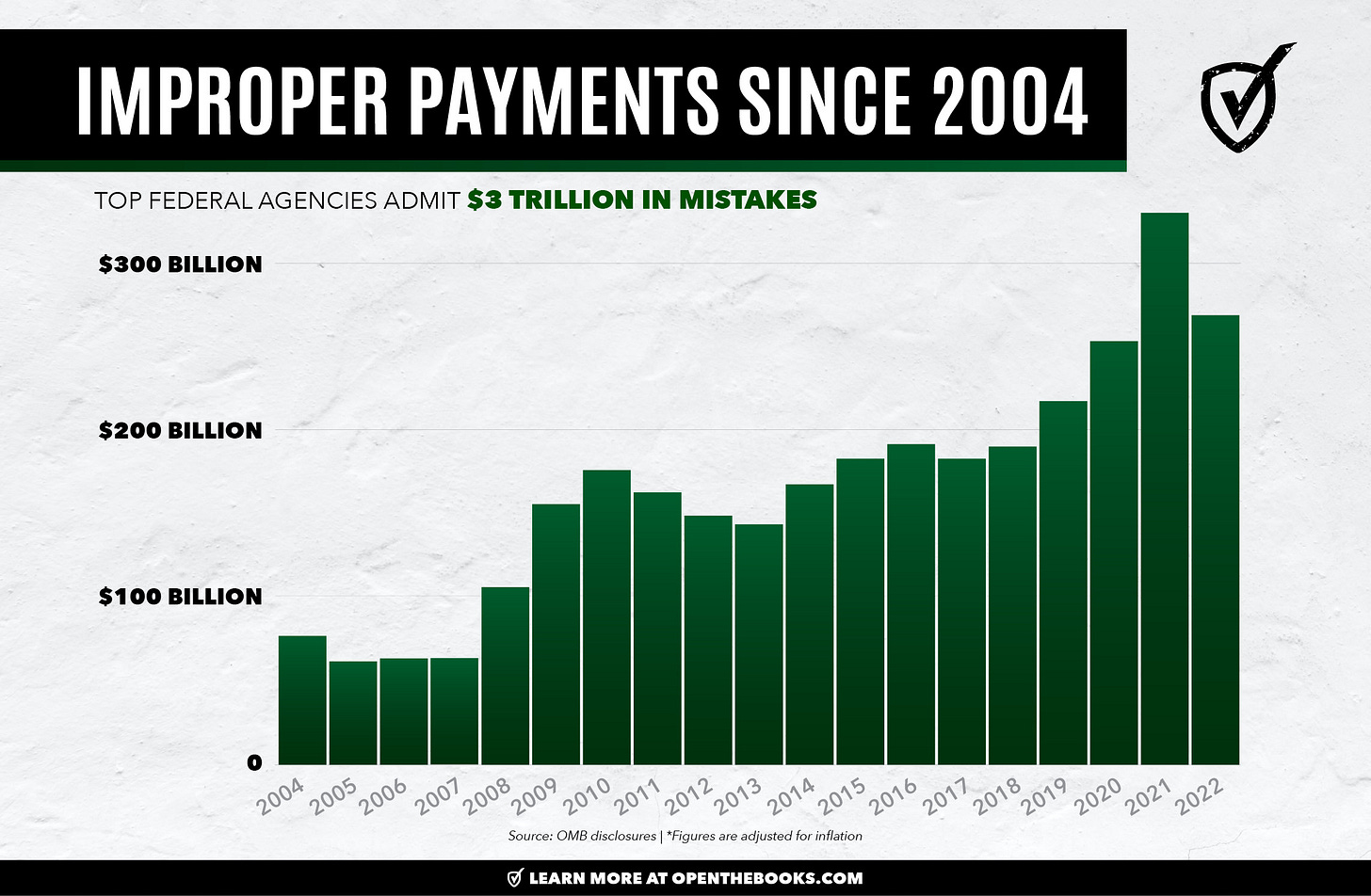

Federal Agencies Admit To $3 Trillion In Improper Payments Since 2004

So, what government program is running well?

Our OpenTheBooks.com auditors quantified the improper and mistaken payments admitted to by the 17 largest federal agencies. It amounts to a staggering $2.9 trillion since 2004, when the totals are adjusted for inflation.

Last year, in 2022, improper and mistaken federal payments totaled $247 billion. That’s about $20.5 billion per month, or more than $675 million every, single day.

What exactly is an improper payment? Federal law defines the term as “payments made by the government to the wrong person, in the wrong amount, or for the wrong reason.”

In other words, a corner grocery store has better accounting controls than our $6.82 trillion U.S. federal government had in 2021.

Pandemic Pinnacle

As the perennial debt ceiling debate raged on inside the Beltway last month, some politicians continued suggesting that even minor spending reductions would be some sort of crisis. But our latest research makes it clear: there is a staggering amount of waste and mistakes to rein in.

The worst year on record was 2021, at the height of the Covid pandemic, when $281 billion was paid out incorrectly. However, in 2022, because of Covid protocols, agencies just weren’t counting some of the mistakes. According to the Government Accountability Office, some programs were “risk-susceptible” as money for Covid aid was quickly shoveled out by Congress. So, the total improper payments certainly would have rivaled the previous worst year ever.

The mistakes since 2004 run at an average of more than $150 billion per year, or more than $400 million paid incorrectly every day.

In 2022, the incorrect payments totaled $1,673 for every individual tax return filed that year. (167,915,264, according to the IRS). They amounted to $846 for every man, woman, and child in the country.

So, the government wasted $3,384 for every family of four – an amount equal to two average mortgage payments. (331,893,745, U.S. pop in 2021, from U.S. Census Bureau website).

Using state-of-the-art tools, our auditors pored over the federal mistaken payments; the results are published here. The findings are stunning given the continued angst over finding budget efficiencies to get the nation’s fiscal house in order.

GRAPHIC: Learn more. Read our full report on Improper Payments at OpenTheBooks.com.

Many Federal Agencies Have an Enormous Error Rate.

The biggest offenders: the Departments of Human & Human Services (HHS), Treasury, Labor (DOL), and Education (ED); and the Small Business Administration (SBA).

Improper payments in health care are especially troubling. In 2011, when President Barack Obama signed the Affordable Care Act, Congress vowed to help pay for it by rooting out waste, fraud, corruption and taxpayer abuse from the Medicare and Medicaid programs.

That never happened.

In fact, the improper payments within these programs soared from $64 billion in 2012 to $136 billion today.

How did the feds waste our money in 2022? Covid-aid programs, as the GAO has said, were especially susceptible to mistakes. Those were in addition to the perennial botched spending.

For starters, dead people received $533 million in benefits: social security payments, federal pensions, and old-age, survivors, and disability insurance kept flowing long after these Americans were gone.

A few more egregious examples:

The Small Business Administration made improper payments through seven of its programs. The Paycheck Protection Program, or PPP, was designed to help small businesses keep employees during the draconian shutdown measures. But it misspent more than $29 billion—$16.5 billion through “unknown” payments, and $12.5 billion by “improper” payments. (The SBA Inspector General has also admitted to $100 billion in fraudulent aid, including $78.1 billion in PPP fraud.)

The Department of Labor spent $18.9 billion incorrectly. Federal State Unemployment Insurance, a program that historically makes up most of the total improper payments, did so again. (Current estimates are $400 billion in unemployment fraud!)

At the Social Security Administration, the Old-Age, Survivors, and Disability Insurance program flubbed $2.5 billion, while Supplemental Security Income sent $4.9 billion astray.

14 Department of Agriculture programs botched $19 billion worth of spending. The Farm Service Agency Coronavirus Food Assistance Program mis-spent $743 million.

The Commodity Credit Corporation Agriculture Risk Coverage and Price Loss Coverage lost $379 million.

The Department of Education admitted that nearly $6 billion went wrong from funds earmarked for “COVID-19 recovery and rebuilding efforts.” Pell Grants, meanwhile, wasted $586 million.

These are just a few of the seemingly endless examples. Read through all of them here.

While lawmakers fight over how many trillions to spend per year, every dollar blown hurts the taxpayers and fails a critical mission.

Federal bureaucrats must find ways to provide more adequate spending controls and stem this enormous tide of improper payments. Otherwise, government waste of this magnitude will only continue eroding the public trust.

Thanks to our team of auditors, taxpayers can research the goofs made in their names and with their dollars. Then they can decide for themselves where spending should grow, and where it should be cut.

Note: We requested comment from each agency mentioned. One replied. The Social Security Administration provided this statement:

“Our accuracy rates are high. For FY 2021, the OASDI overpayment accuracy rate was 99.8% and the underpayment accuracy rate was 99.9%. The $2.5 billion in OASDI improper payments reflect less than one quarter of one percent of outlays. The FY 2021 SSI overpayment accuracy rate was 92.8% and the underpayment accuracy rate was 98.4 percent. The slightly lower SSI accuracy rate reflects the complexity of that program including cumbersome reporting requirements that require us to have the resources to act timely. While our payment accuracy rates are high, even small error rates add up to substantial improper payment amounts because of the magnitude of the benefits we pay each year.”

ABOUT US

OpenTheBooks.com – We believe transparency is transformational. Using forensic auditing and open records, we hold government accountable.

In the years 2021 and 2022, we filed 100,000+ FOIA requests and successfully captured $19 trillion government expenditures: nearly all federal spending; 50 state checkbooks; and 25 million public employee salary and pension records from 50,000 public bodies across America.

Our works have been featured at the BBC, Good Morning America, ABC World News Tonight, The Wall Street Journal, USA Today, C-SPAN, Chicago Tribune, The New York Times, NBC News, FOX News, Forbes, National Public Radio (NPR), Sinclair Broadcast Group, & many others.

Our organization accepts no government funding and was founded by CEO Adam Andrzejewski. Our federal oversight work was cited twice in the President's Budget To Congress FY2021. Andrzejewski's presentation, The Depth of the Swamp, at the Hillsdale College National Leadership Seminar 2020 in Naples, Florida posted on YouTube received 3.8+ million views.

NOTICE: We reserve the right to remove comments that deemed offensive to our organization, staff, and audience.

No wonder we are 32 trillion in debt. Government needs a huge cut, starting with ending many unauthorized but still funded programs. Rep. Clay Higgins addressed this issue. We need a President willing to dismantle several federal agencies and health agencies. Total waste, fraud, corruption runs deep in DC.

Who is going to lose their job as a result of these improper payments? What government agency will lose their funding as a result of these improper payments? What, in other words, is going to fix this problem going forward?